Dubai International Financial Centre - All You Need to Know

Dubai International Financial Centre (DIFC) is a prominent financial hub located in the heart of Dubai, United Arab Emirates. Established in 2004, DIFC has quickly become a leading financial center in the region, offering a wide range of financial services and products to businesses and individuals. DIFC is home to numerous global financial institutions, law firms, and corporate offices, making it a key player in the international financial landscape. The center provides a world-class regulatory environment, state-of-the-art infrastructure, and a highly skilled workforce, attracting investors and businesses from around the world. With its strategic location, robust regulatory framework, and business-friendly policies, DIFC continues to play a vital role in driving economic growth and innovation in the region.

Introduction

The Dubai International Financial Centre (DIFC) serves as a prominent financial hub in the Middle East, offering a conducive environment for businesses and financial institutions to thrive. Established in 2004, the DIFC has become a key player in the region's financial landscape, providing a range of services and infrastructure to support the growth of the financial sector. With its strategic location, world-class facilities, and robust regulatory framework, the DIFC has attracted a diverse range of international companies and financial institutions, cementing its reputation as a leading financial center in the region.

Overview of Dubai International Financial Centre (DIFC)

The Dubai International Financial Centre (DIFC) is a leading financial hub in the Middle East, located in the heart of Dubai. Established in 2004, DIFC serves as a platform for financial institutions to operate within a secure and well-regulated environment. It offers a wide range of services, including banking, asset management, insurance, and capital markets. DIFC is known for its modern infrastructure, state-of-the-art facilities, and a business-friendly regulatory framework that attracts both regional and international businesses. With its strategic location, world-class amenities, and strong legal system based on English common law, DIFC has become a key player in the global financial industry, fostering economic growth and innovation in the region.

Importance of DIFC as a financial hub in the Middle East and MEASA region

The Dubai International Financial Centre (DIFC) holds immense significance as a financial hub in the Middle East and MEASA region. Established as a leading global financial center in 2004, DIFC has played a pivotal role in driving economic growth, fostering innovation, and attracting foreign investment to the region. With its robust regulatory framework, business-friendly environment, and state-of-the-art infrastructure, DIFC has become a magnet for financial institutions, multinational corporations, and startups seeking to establish a presence in the region. Its strategic location at the crossroads of East and West, coupled with a diverse and talented workforce, has positioned DIFC as a key player in the international financial landscape. The center's commitment to excellence, transparency, and regulatory compliance has instilled trust among investors and stakeholders, further solidifying its reputation as a premier financial hub in the Middle East and MEASA region.

DIFC's role in promoting economic growth and attracting international businesses

The Dubai International Financial Centre (DIFC) plays a crucial role in promoting economic growth and attracting international businesses to the region. As a leading financial hub in the Middle East, DIFC provides a world-class platform for companies to establish their presence and expand their operations in the region. By offering a business-friendly environment, state-of-the-art infrastructure, and a robust regulatory framework, DIFC creates a conducive atmosphere for international businesses to thrive. Additionally, DIFC's strategic location in Dubai, a global business and trade hub, further enhances its attractiveness to multinational corporations seeking to access the Middle East, Africa, and South Asia markets. Overall, DIFC's proactive efforts in fostering economic growth and attracting international businesses contribute significantly to Dubai's position as a global business destination.

Location and Infrastructure

The Dubai International Financial Centre (DIFC) is strategically located in the heart of Dubai, a leading global financial hub. Its prime location provides easy access to key business districts, government offices, and transportation hubs, making it an ideal choice for international businesses seeking a strong presence in the region. The infrastructure within the DIFC is world-class, with state-of-the-art office buildings, advanced technology systems, and modern amenities that cater to the needs of its diverse range of tenants. The DIFC's commitment to providing a seamless business environment is further enhanced by its efficient transport links, including proximity to major highways and airports, ensuring smooth connectivity for businesses and visitors alike.

DIFC's strategic location in the Emirate of Dubai

The Dubai International Financial Centre (DIFC) holds a strategically advantageous position within the Emirate of Dubai, serving as a pivotal hub for global finance and business activities. Situated in the heart of Dubai's bustling metropolis, DIFC's location offers unparalleled connectivity to key markets in the Middle East, Africa, and South Asia. This strategic positioning not only facilitates seamless access to a diverse range of investors and stakeholders but also enhances the center's attractiveness as a premier destination for multinational corporations seeking to establish a presence in the region. Furthermore, DIFC's proximity to major transportation networks, including Dubai International Airport and Jebel Ali Port, ensures efficient logistical support for businesses operating within its jurisdiction. In essence, DIFC's strategic location in the Emirate of Dubai underscores its significance as a dynamic and thriving financial hub with global reach and influence.

Description of DIFC's state-of-the-art infrastructure and facilities

The Dubai International Financial Centre (DIFC) boasts a state-of-the-art infrastructure that is unparalleled in the region. The meticulously designed facilities within the DIFC cater to the specific needs of financial institutions, multinational corporations, and professional service firms. The cutting-edge technology integrated throughout the center ensures seamless connectivity and efficient operations for all tenants. The DIFC's infrastructure includes modern office spaces equipped with the latest amenities, advanced security systems, world-class dining and retail options, as well as convenient access to transportation and parking facilities. Overall, the DIFC's state-of-the-art infrastructure and facilities create a conducive environment for businesses to thrive and succeed in the global financial landscape.

Advantages of DIFC's free zone status for businesses

The Dubai International Financial Centre (DIFC) offers numerous advantages to businesses through its free zone status. Firstly, companies operating within the DIFC benefit from 100% foreign ownership, enabling full control and autonomy over their business operations. This facilitates a more conducive environment for international firms looking to establish a presence in the region. Additionally, the DIFC provides a tax-free environment, allowing businesses to maximize their profits and reinvest capital back into their operations. Furthermore, the free zone status grants access to a pool of skilled professionals, a robust regulatory framework, and state-of-the-art infrastructure, all of which contribute to a competitive edge in the global market. Overall, the DIFC's free zone status serves as a catalyst for business growth, innovation, and success in the dynamic landscape of the financial industry.

Legal and Regulatory Framework

The legal and regulatory framework within the Dubai International Financial Centre (DIFC) plays a pivotal role in fostering a secure and conducive environment for financial activities. DIFC operates under a separate legal system based on English common law principles, providing a robust foundation for business operations within the center. The regulatory framework is overseen by the Dubai Financial Services Authority (DFSA), which enforces strict compliance standards to ensure transparency, accountability, and investor protection. Additionally, DIFC offers a comprehensive set of laws and regulations that govern various aspects of financial services, including banking, insurance, and capital markets, thereby promoting stability and confidence in the financial sector. Overall, the legal and regulatory framework in DIFC exemplifies a commitment to upholding international best practices and standards, reinforcing its position as a leading global financial hub.

Overview of DIFC's common law jurisdiction and independent judicial system

The Dubai International Financial Centre (DIFC) boasts a common law jurisdiction and an independent judicial system that set it apart as a prominent global financial hub. The DIFC's common law framework is based on principles derived from English law, providing a familiar and reliable legal environment for international businesses and investors. The DIFC's independent judicial system, with its own courts and legal procedures, further enhances the center's appeal by offering a transparent and efficient mechanism for resolving disputes. This unique combination of common law jurisdiction and an independent judiciary reinforces the DIFC's reputation as a secure and business-friendly destination for financial activities and investments.

Explanation of how DIFC's courts operate and provide legal certainty

The Dubai International Financial Centre (DIFC) operates its courts with a meticulous focus on providing legal certainty to businesses and individuals within its jurisdiction. The DIFC courts follow a robust legal framework that is based on common law principles, ensuring consistency and predictability in their decisions. This framework is supported by a panel of highly qualified judges with international expertise in commercial law, who ensure the fair and impartial adjudication of disputes. Additionally, the DIFC courts offer a range of alternative dispute resolution mechanisms, such as mediation and arbitration, to expedite the resolution of conflicts and enhance legal certainty for parties involved. Overall, the efficient operation and commitment to upholding the rule of law within the DIFC courts contribute significantly to fostering a secure and conducive environment for conducting business and resolving legal matters in the region.

Role of DIFC Authority in regulating and supervising financial activities

The Dubai International Financial Centre (DIFC) Authority plays a crucial role in regulating and supervising financial activities within the DIFC. As the independent regulator of the financial free zone, the DIFC Authority is responsible for ensuring the integrity, transparency, and stability of the financial services industry operating within its jurisdiction. By setting and enforcing robust regulatory standards, the DIFC Authority aims to foster a secure and competitive environment that attracts international businesses and investors. Through its oversight and supervision of financial institutions, the DIFC Authority helps maintain the reputation of the DIFC as a leading global financial center, promoting confidence in the integrity of financial transactions conducted within its boundaries.

Financial Services and Institutions

The Dubai International Financial Centre (DIFC) plays a crucial role in facilitating financial services and institutions within its jurisdiction. As a leading financial hub in the Middle East, the DIFC provides a robust regulatory framework, state-of-the-art infrastructure, and a conducive business environment for various financial institutions to operate effectively. The DIFC serves as a platform for banks, insurance companies, investment firms, and other financial service providers to conduct their operations in compliance with international standards and best practices. Through its innovative initiatives and strategic partnerships, the DIFC has positioned itself as a key player in promoting financial stability, growth, and innovation in the region.

Range of financial services offered within DIFC

The Dubai International Financial Centre (DIFC) offers a comprehensive range of financial services to cater to the diverse needs of its clients. These services encompass banking, asset management, wealth management, capital markets, insurance, and Islamic finance. Within the DIFC, financial institutions provide a wide array of products and solutions, including corporate banking, trade finance, private banking, investment advisory, fund management, and reinsurance. Additionally, the DIFC is known for its robust regulatory framework that ensures a secure and transparent environment for conducting financial transactions. Overall, the range of financial services offered within the DIFC reflects its stature as a leading global financial hub.

Overview of major financial institutions and banks operating in DIFC

The Dubai International Financial Centre (DIFC) is home to a diverse array of major financial institutions and banks, contributing to its status as a leading financial hub in the region. Some of the prominent institutions operating within the DIFC include HSBC, Standard Chartered, Citibank, Emirates NBD, and Mashreq Bank. These institutions offer a wide range of financial services including banking, wealth management, investment banking, and corporate finance. Their presence underscores the robust regulatory framework and business-friendly environment that the DIFC provides, attracting both local and international financial institutions to establish a strong presence within its jurisdiction. The collective presence of these institutions enhances the overall financial ecosystem of the DIFC, further solidifying its reputation as a key player in the global financial landscape.

Importance of DIFC as a leading financial center in the Middle East

The Dubai International Financial Centre (DIFC) holds significant importance as a leading financial center in the Middle East due to its strategic location, robust regulatory framework, and world-class infrastructure. Serving as a gateway between the East and the West, DIFC provides a conducive environment for international financial institutions, businesses, and investors to thrive. Its regulatory framework, based on English common law principles, instills confidence and transparency in the financial sector, attracting global players seeking a stable and secure business environment. Furthermore, DIFC's state-of-the-art infrastructure, coupled with a pool of skilled professionals, fosters innovation and growth in various financial services sectors, positioning it as a key player in the region's economic landscape.

Business Environment

The business environment within the Dubai International Financial Centre (DIFC) is characterized by a robust regulatory framework, a strategic location, and a diverse pool of multinational corporations and financial institutions. The DIFC serves as a premier financial hub in the Middle East, offering a conducive ecosystem for businesses to thrive and expand their operations. With its state-of-the-art infrastructure, advanced technological capabilities, and a business-friendly legal system based on English common law, the DIFC provides a secure and stable environment for investors and entrepreneurs. Furthermore, the DIFC's commitment to fostering innovation and entrepreneurship through various initiatives and programs further enhances the overall business environment, making it an attractive destination for companies looking to establish a presence in the region.

Advantages of setting up a business in DIFC

There are several advantages to setting up a business in the Dubai International Financial Centre (DIFC). Firstly, the DIFC offers a strategic location in the heart of Dubai, providing easy access to key markets in the Middle East, Africa, and South Asia. Secondly, businesses established in the DIFC benefit from a world-class regulatory framework that promotes transparency, efficiency, and investor confidence. Additionally, the DIFC provides state-of-the-art infrastructure and a supportive business environment, including access to a pool of skilled professionals and a network of financial institutions. Furthermore, companies operating in the DIFC enjoy zero percent tax on income and profits, providing a competitive edge in the region. Overall, setting up a business in the DIFC offers a unique opportunity to thrive in a dynamic and growing market while benefitting from a robust regulatory framework and favorable tax incentives.

Overview of DIFC's supportive ecosystem for startups and entrepreneurs

The Dubai International Financial Centre (DIFC) offers a highly supportive ecosystem for startups and entrepreneurs, providing a platform that fosters innovation, collaboration, and growth. With its strategic location and world-class infrastructure, DIFC serves as a hub for financial services and technology companies, offering access to a vast network of investors, mentors, and industry experts. The DIFC also provides various programs, initiatives, and events tailored to support startups at different stages of their growth journey, including incubation services, accelerator programs, and networking opportunities. Additionally, the DIFC's regulatory framework is designed to facilitate business setup and operations, ensuring a conducive environment for startups to thrive and succeed in the competitive market landscape.

Role of DIFC in fostering innovation and attracting fintech companies

The Dubai International Financial Centre (DIFC) plays a pivotal role in fostering innovation and attracting fintech companies through its robust regulatory framework, strategic location, and supportive ecosystem. As a leading financial hub in the Middle East, DIFC provides a conducive environment for fintech startups and established companies to thrive and grow. The center's progressive regulatory environment promotes innovation by creating a safe and secure platform for companies to test and implement cutting-edge technologies. Additionally, DIFC's strategic location in Dubai offers easy access to a diverse pool of talent, investors, and potential partners, further enhancing its appeal to fintech companies. The center's commitment to fostering a culture of innovation and collaboration through initiatives such as the FinTech Hive accelerator program demonstrates its dedication to attracting and supporting fintech innovation.

Retail and Dining

The Dubai International Financial Centre (DIFC) offers a diverse range of retail and dining options to cater to the needs of its residents, visitors, and professionals. The retail landscape within the DIFC is characterized by upscale boutiques, luxury brands, and specialty stores, providing a sophisticated shopping experience for discerning consumers. Additionally, the dining scene in the DIFC is renowned for its world-class restaurants, cafes, and eateries, offering a wide array of cuisines to suit every palate. Whether one is looking for a quick bite to eat or a fine dining experience, the DIFC's retail and dining establishments ensure a high standard of quality and service, making it a premier destination for shopping and dining in Dubai.

Description of retail and dining options available within DIFC

Within the Dubai International Financial Centre (DIFC), there is a diverse range of retail and dining options available to cater to the discerning tastes of its visitors and residents. The retail offerings within DIFC include high-end fashion boutiques, luxury jewelry stores, and upscale homeware shops, providing a sophisticated shopping experience for those seeking quality and exclusivity. Additionally, the dining scene in DIFC is equally impressive, with a plethora of world-class restaurants, trendy cafes, and chic bars offering a variety of cuisines from around the globe. Whether one is in the mood for a fine dining experience, a casual meal with colleagues, or a quick coffee break, DIFC provides an array of options to suit every preference and occasion.

Overview of high-end shops, boutiques, and restaurants in DIFC

The Dubai International Financial Centre (DIFC) is renowned for its upscale shopping and dining options, catering to the affluent clientele of the financial district. The area boasts a wide array of high-end shops, boutiques, and restaurants that cater to the discerning tastes of its visitors. From luxury fashion brands to exclusive jewelry stores, DIFC offers a premium shopping experience. Additionally, the district is home to a variety of fine dining establishments, ranging from Michelin-starred restaurants to trendy cafes, ensuring that visitors have a plethora of culinary options to choose from. Overall, the high-end shops, boutiques, and restaurants in DIFC contribute to the area's reputation as a sophisticated and cosmopolitan destination for luxury shopping and dining experiences.

Importance of retail and dining establishments in creating a vibrant atmosphere

Retail and dining establishments play a crucial role in creating a vibrant atmosphere within the Dubai International Financial Centre (DIFC). These establishments not only cater to the practical needs of the professionals and visitors within the financial district but also contribute significantly to the overall ambiance and energy of the area. Retail outlets provide a diverse range of products and services, enhancing the convenience and accessibility for individuals working or residing in the DIFC. Additionally, dining establishments offer a variety of culinary experiences, creating a social hub where professionals can network, socialize, and unwind. The presence of these establishments fosters a sense of community and vitality, making the DIFC a more attractive and dynamic destination for both business and leisure activities.

Work and Professional Life

In the context of the Dubai International Financial Centre (DIFC), work and professional life are paramount to the success and growth of individuals and businesses within this dynamic financial hub. The DIFC serves as a platform for fostering a culture of excellence, innovation, and collaboration among professionals from diverse backgrounds and industries. With a strong emphasis on professionalism and high standards, individuals working in the DIFC are expected to demonstrate a strong work ethic, dedication to their craft, and a commitment to upholding the integrity of the financial services sector. By prioritizing work and professional development, individuals in the DIFC can contribute to the overall success and reputation of this leading global financial center.

Overview of professional work opportunities within DIFC

The Dubai International Financial Centre (DIFC) offers a diverse range of professional work opportunities across various sectors within the financial industry. As a leading financial hub in the region, DIFC provides a conducive environment for financial institutions, professional services firms, and fintech companies to establish and grow their presence. Job opportunities within DIFC encompass roles in banking, asset management, insurance, legal services, accounting, and technology, among others. With a strong regulatory framework, world-class infrastructure, and a pool of talented professionals, DIFC serves as an attractive destination for individuals seeking challenging and rewarding careers in the financial sector. The center's commitment to innovation, collaboration, and excellence further enhances the appeal of pursuing professional work opportunities within DIFC.

Description of the active register of professionals in various fields

The active register of professionals in various fields within the Dubai International Financial Centre (DIFC) serves as a comprehensive database containing detailed information about individuals practicing in the financial, legal, and business sectors. This register plays a crucial role in ensuring that only qualified and licensed professionals are able to operate within the DIFC, in alignment with the regulatory standards and requirements of the financial center. It includes essential details such as the professional qualifications, areas of expertise, and licensing status of each individual, providing transparency and accountability in the professional services offered within the DIFC. Access to this register allows stakeholders to verify the credentials of professionals, facilitating trust and confidence in the integrity of the financial services industry within the DIFC.

Importance of DIFC as a hub for professional services in the region

The Dubai International Financial Centre (DIFC) plays a pivotal role as a hub for professional services in the region due to its strategic location, robust regulatory framework, and world-class infrastructure. As a leading financial free zone in the Middle East, DIFC attracts a diverse range of global companies and financial institutions, fostering a vibrant ecosystem of professional services providers. The presence of top law firms, accounting firms, and consultancy firms within DIFC facilitates access to high-quality expertise and services for businesses operating in various sectors. Additionally, DIFC's emphasis on innovation and technology integration ensures that professionals in the center are equipped with the latest tools and knowledge to meet the evolving needs of clients in the region. Overall, DIFC's status as a hub for professional services enhances the competitiveness and attractiveness of Dubai as a global business destination.

Future of DIFC

The future of the Dubai International Financial Centre (DIFC) appears promising as it continues to solidify its position as a leading financial hub in the region. With its strategic location, world-class infrastructure, and business-friendly environment, the DIFC is well-positioned to attract more international companies and investors. Additionally, the DIFC's focus on innovation and technology, particularly in the areas of fintech and sustainability, will likely drive further growth and opportunities in the coming years. As the global economy evolves, the DIFC is poised to adapt and thrive, maintaining its status as a key player in the international financial landscape.

Analysis of DIFC's potential for growth and expansion

The Dubai International Financial Centre (DIFC) presents a promising potential for growth and expansion. As a leading financial hub in the Middle East, DIFC has established itself as a key player in the global financial industry. With its strategic location, world-class infrastructure, and business-friendly environment, DIFC has attracted a diverse range of financial institutions and multinational corporations. The center's commitment to innovation and technology, coupled with its regulatory framework aligned with international standards, positions it for sustained growth in the coming years. Furthermore, DIFC's focus on fostering a vibrant ecosystem for fintech startups and emerging technologies underscores its readiness to adapt to evolving market trends and capitalize on new opportunities. Overall, the analysis of DIFC's potential for growth and expansion indicates a bright outlook for its continued success and influence in the global financial landscape.

Discussion of DIFC's role in shaping the future of finance in the Middle East

The Dubai International Financial Centre (DIFC) plays a pivotal role in shaping the future of finance in the Middle East by providing a robust platform for financial institutions and businesses to thrive in the region. As a leading financial hub, DIFC offers a conducive regulatory environment, world-class infrastructure, and a pool of skilled professionals that attract global investors and promote financial innovation. The DIFC's strategic location in Dubai, a cosmopolitan and dynamic city, further enhances its position as a gateway for investment and trade between the East and the West. By fostering collaboration, fostering innovation, and driving economic growth, DIFC is instrumental in positioning the Middle East as a key player in the global financial landscape.

Exploration of DIFC's initiatives to attract more businesses and investments

The Dubai International Financial Centre (DIFC) has implemented a series of strategic initiatives aimed at attracting more businesses and investments to its jurisdiction. These initiatives include regulatory reforms to enhance the ease of doing business, such as the introduction of a new insolvency law and a revamped company law framework. Additionally, DIFC has focused on fostering a conducive business environment through the establishment of state-of-the-art infrastructure and facilities, as well as promoting innovation and technology within the financial services sector. By offering a business-friendly regulatory environment, world-class infrastructure, and a commitment to innovation, DIFC has positioned itself as a leading global financial hub, attracting a diverse range of businesses and investments from around the world.

Conclusion

In conclusion, the Dubai International Financial Centre (DIFC) stands as a leading financial hub in the Middle East, offering a world-class ecosystem for businesses and financial institutions to thrive. With its strategic location, state-of-the-art infrastructure, and robust regulatory framework, the DIFC has successfully attracted top-tier companies and investors from around the globe. As a key player in the region's financial landscape, the DIFC continues to drive innovation, foster economic growth, and facilitate cross-border trade and investment. Its commitment to excellence and adherence to international best practices position it as a premier destination for financial services and business opportunities in the Middle East and beyond.

Summary of the key points highlighting DIFC's significance and impact

The Dubai International Financial Centre (DIFC) holds significant importance as a leading financial hub in the Middle East, providing a conducive environment for businesses and financial institutions to thrive. Its strategic location in Dubai, a global business and trade hub, enhances its accessibility and attractiveness to international investors. The DIFC's robust regulatory framework, based on English common law principles, instills confidence and stability in the financial sector, fostering trust among market participants. Moreover, the DIFC's state-of-the-art infrastructure and world-class facilities support the operations of multinational corporations, financial institutions, and startups, contributing to economic growth and diversification in the region. Overall, the DIFC's impact extends beyond its borders, positioning Dubai as a key player in the global financial landscape and driving innovation and excellence in the industry.

Final thoughts on the future prospects of DIFC as a leading international financial center

In conclusion, the future prospects of the Dubai International Financial Centre (DIFC) as a leading international financial center appear promising. With its strategic location, world-class infrastructure, and business-friendly environment, the DIFC is well-positioned to attract global financial institutions and investors. The continued focus on innovation, regulatory excellence, and fostering a diverse financial ecosystem further enhances its competitiveness on the international stage. However, challenges such as geopolitical uncertainties and evolving market dynamics must be navigated adeptly to sustain its growth trajectory. Overall, with a commitment to adaptability, innovation, and strategic partnerships, the DIFC is poised to solidify its position as a premier hub for financial services in the region and beyond.

Integration of Pertinent Points

The integration of pertinent points within the Dubai International Financial Centre (DIFC) is crucial for its continued success and growth as a leading financial hub. By effectively integrating relevant information, regulations, and market trends, the DIFC can enhance its competitiveness and attractiveness to global businesses and investors. This includes the seamless incorporation of international best practices, regulatory frameworks, and technological advancements to ensure the DIFC remains at the forefront of innovation and efficiency in the financial services industry. Furthermore, the integration of pertinent points facilitates effective decision-making processes, risk management strategies, and compliance measures, ultimately contributing to the overall stability and sustainability of the DIFC ecosystem.

Explanation of DIFC's role as a cost-effective hub for financial services in the MEASA region

The Dubai International Financial Centre (DIFC) serves as a cost-effective hub for financial services in the MEASA region by offering a strategic location, a business-friendly regulatory environment, and world-class infrastructure. Situated at the heart of Dubai, DIFC provides easy access to markets across the Middle East, Africa, and South Asia. Its robust regulatory framework, based on common law principles, ensures transparency, stability, and investor protection, attracting a wide range of financial institutions and professional services firms. Moreover, the DIFC's state-of-the-art infrastructure, including modern office spaces and cutting-edge technology, enables businesses to operate efficiently and competitively. Overall, DIFC's role as a cost-effective hub for financial services in the MEASA region is underscored by its commitment to fostering growth, innovation, and sustainability in the global financial landscape.

Overview of DIFC's influence on the financial sector in East Africa and Asia MEASA

The Dubai International Financial Centre (DIFC) has significantly impacted the financial sector in East Africa and Asia MEASA region through its role as a leading financial hub. With its strategic location and business-friendly environment, DIFC has attracted a multitude of financial institutions, multinational corporations, and investment firms seeking to access the emerging markets in these regions. DIFC's robust regulatory framework, based on international best practices, has fostered a culture of transparency and stability, enhancing investor confidence and attracting foreign direct investment. Furthermore, DIFC's focus on innovation and technology has promoted the development of fintech solutions, enabling financial inclusion and driving economic growth in East Africa and Asia MEASA. Overall, DIFC's influence has been instrumental in shaping the financial landscape of these regions, positioning them as key players in the global economy.

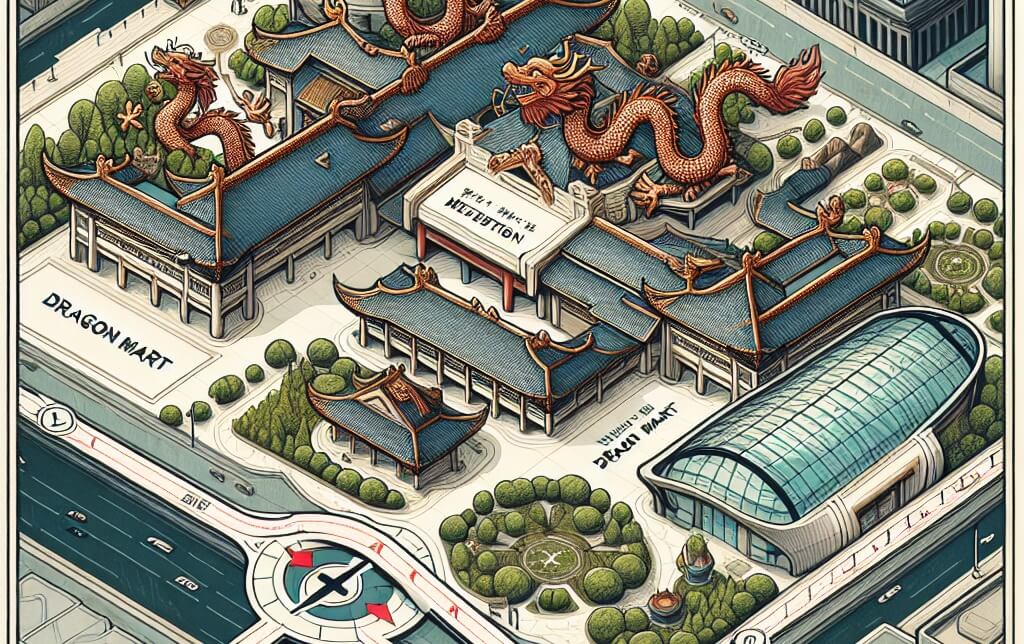

Description of DIFC's initiatives to support fintech companies, such as the Fintech Hive

The Dubai International Financial Centre (DIFC) has implemented various initiatives to support fintech companies, with one prominent program being the Fintech Hive. This initiative serves as a platform for fostering innovation and collaboration within the fintech sector by providing startups with access to resources, mentorship, and networking opportunities. Through the Fintech Hive, DIFC aims to accelerate the growth of fintech companies by facilitating partnerships with established financial institutions and promoting the development of cutting-edge solutions for the financial services industry. By creating a conducive ecosystem for fintech innovation, DIFC is positioning itself as a leading hub for fintech in the region and driving the advancement of the financial technology sector.