Greece Properties Prices

The current landscape of Greece's property market is characterized by a notable fluctuation in prices. Factors such as economic conditions, demand-supply dynamics, and government policies play pivotal roles in shaping the pricing trends within the real estate sector. In recent years, there has been a discernible trend of property prices experiencing both increases and decreases, reflecting the market's inherent volatility. It is essential for prospective buyers and investors to closely monitor these fluctuations and conduct thorough market research to make informed decisions regarding property acquisitions in Greece. Additionally, consulting with real estate experts and leveraging industry insights can provide valuable guidance in navigating the nuances of Greece's property prices.

I. Introduction

In recent years, the property market in Greece has garnered significant attention due to fluctuating prices and evolving trends. The dynamics of property prices in Greece are influenced by various factors, such as economic conditions, supply and demand dynamics, and government policies. Understanding the nuances of property prices in Greece is crucial for investors, homeowners, and real estate professionals seeking to navigate this complex market effectively. In this context, a comprehensive analysis of Greece's property prices is essential to provide insights into the current state of the market and forecast future trends.

II. Factors Affecting Greece Properties Prices

There are several key factors that influence property prices in Greece. One significant factor is the state of the economy, as a strong economy typically leads to increased demand for properties, driving prices up. Additionally, the location of the property plays a crucial role, with properties in popular tourist destinations or urban centers commanding higher prices. Government policies and regulations, such as property taxes and zoning laws, also impact property prices. Furthermore, the overall stability of the political environment can influence investor confidence and, subsequently, property prices. Lastly, factors like interest rates, demographic trends, and the overall condition of the real estate market also contribute to the fluctuations in Greece's property prices.

III. Residential Property Prices in Greece

Residential property prices in Greece have experienced fluctuations in recent years, influenced by various economic factors. The global financial crisis of 2024 had a significant impact on the Greek real estate market, leading to a sharp decline in property prices. Subsequent austerity measures and economic instability further contributed to the volatility in the housing sector. However, in more recent years, there has been a gradual recovery in property prices, driven by increased foreign investment and government initiatives to stimulate the real estate market. Despite this positive trend, challenges such as high levels of non-performing loans and the impact of the COVID-19 pandemic have continued to pose obstacles to sustained growth in Greece's residential property market.

IV. house prices in greece

IV. house prices in greece have experienced fluctuations in recent years due to various economic factors and market conditions. The real estate market in Greece has been greatly influenced by the country's economic crisis, which led to a significant decline in property prices. However, in recent times, there has been a gradual recovery in the housing market, with prices starting to stabilize and even show signs of growth in certain regions. Factors such as location, property size, and amenities continue to play a crucial role in determining house prices in greece. It is essential for potential buyers and investors to closely monitor market trends and seek professional advice to make informed decisions in this dynamic real estate landscape.

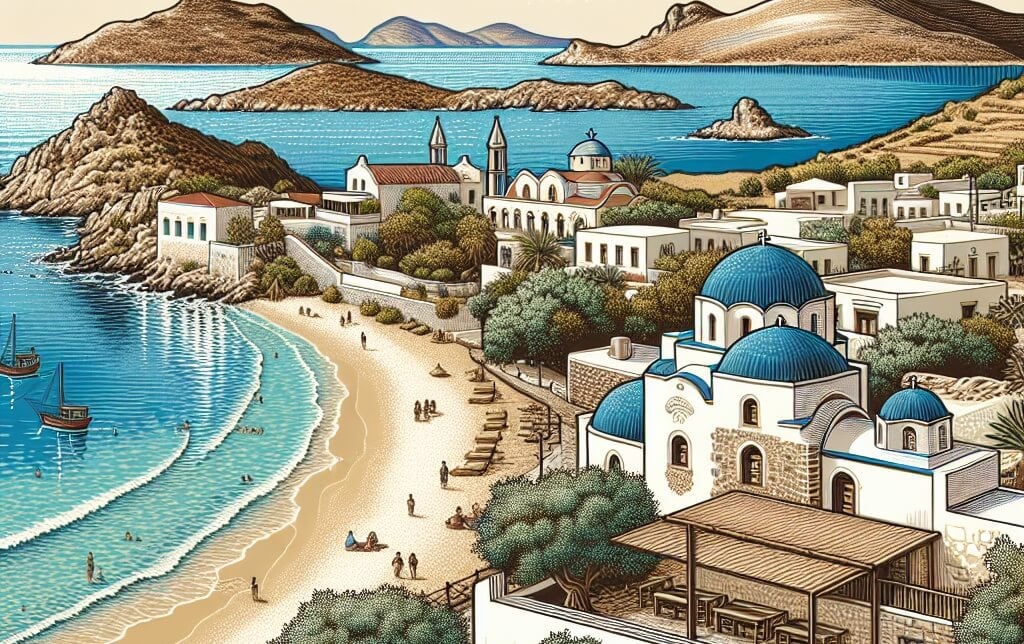

V. Greek Islands Property Prices

The property prices in the Greek Islands, particularly in popular destinations such as Santorini, Mykonos, and Crete, have experienced a notable increase in recent years. The demand for real estate in these sought-after locations, driven by both domestic and international buyers, has contributed to the upward trend in prices. Factors such as limited availability of land for development, the allure of a Mediterranean lifestyle, and the potential for rental income from tourism have all played a role in driving the property market in the Greek Islands. As a result, investors and prospective homeowners should carefully consider market trends, location-specific factors, and potential returns on investment when evaluating property prices in this region.

VI. Commercial Property Prices in Greece

Commercial property prices in Greece have experienced fluctuations over recent years, influenced by various economic factors and market conditions. The demand for commercial properties in key locations such as Athens and Thessaloniki has remained relatively stable, leading to steady price growth in these areas. However, the overall economic challenges faced by Greece, including high unemployment rates and a slow recovery from the financial crisis, have also impacted commercial property prices negatively in some regions. Investors looking to enter the Greek commercial property market should carefully assess the current economic climate and market trends to make informed decisions regarding their investments.

VII. Square Meter Prices in Greece

The square meter prices in Greece, as outlined in the report VII. Square Meter Prices in Greece, reflect the current market conditions for properties in the region. Factors such as location, property type, and economic trends play a significant role in determining the prices of real estate in Greece. It is essential for potential buyers and investors to consider these factors carefully when evaluating property prices in order to make informed decisions. The data provided in the report serves as a valuable resource for individuals interested in understanding the pricing dynamics of the Greek real estate market and can aid in guiding their investment strategies effectively.

VIII. Impact of Greece Properties Prices on the Economy

The impact of Greece properties prices on the economy is significant and multi-faceted. Fluctuations in property prices can directly affect consumer wealth and confidence, influencing spending patterns and overall economic growth. High property prices can lead to increased household debt levels, reducing disposable income and potentially dampening consumption. Moreover, a booming property market can attract foreign investment, stimulating economic activity and creating jobs. Conversely, a downturn in property prices can have a negative impact on the banking sector, as mortgage defaults may rise, leading to financial instability. Therefore, policymakers must closely monitor Greece's property market to ensure its stability and mitigate any adverse effects on the broader economy.

IX. Conclusion

In conclusion, the analysis of property prices in Greece reveals a complex and dynamic market environment. Factors such as location, property type, economic conditions, and demand-supply dynamics all play a significant role in shaping property prices in the country. Despite the challenges posed by the economic crisis in recent years, there are still opportunities for investment in the Greek property market, particularly in popular tourist destinations and urban centers. Moving forward, it will be crucial for investors and stakeholders to closely monitor market trends and regulatory developments to make informed decisions and capitalize on the potential growth opportunities in the Greek property sector.

Integration of Pertinent Points:

In the context of analyzing Greece properties prices, the integration of pertinent points is crucial for a comprehensive understanding of the market trends and factors influencing property values. By synthesizing relevant data such as location, property size, amenities, and market demand, one can gain valuable insights into the pricing dynamics of real estate in Greece. This integration allows for a more informed decision-making process for investors, buyers, and sellers alike, enabling them to navigate the market with a strategic approach. Furthermore, by incorporating these pertinent points into analysis and decision-making processes, stakeholders can better position themselves to capitalize on opportunities and mitigate risks in the dynamic landscape of Greece's property market.