Latest Greece Housing Prices: Trends, Analysis & Insights

The latest trends in Greece's housing prices reveal a complex landscape characterized by both challenges and opportunities. Analysis of the market indicates a gradual increase in property values, reflecting a growing demand for housing in key urban centers. However, this growth is tempered by economic uncertainties and regulatory changes that impact the real estate sector. Insights into the housing market suggest a need for strategic planning and informed decision-making for both buyers and sellers. Understanding the underlying factors driving these trends is crucial for navigating the dynamic environment of Greece's housing market.

Introduction

In the context of Greece's housing market, the introduction serves as a crucial aspect in understanding the dynamics of housing prices within the country. The introduction provides a comprehensive overview of the factors influencing the fluctuations in housing prices, such as economic conditions, government policies, and market trends. By establishing a solid foundation in the introductory section, readers can gain insights into the current state of the housing market in Greece and the potential implications for both buyers and sellers. Additionally, the introduction sets the tone for the subsequent analysis and discussion of housing prices, offering a roadmap for further exploration of this complex and dynamic sector.

Overview of the current state of Greece housing prices and the factors that influence them.

The current state of housing prices in Greece is influenced by a variety of factors. The country's economic conditions, including GDP growth and unemployment rates, play a significant role in determining the demand for housing and subsequently affecting prices. Additionally, government policies and regulations, such as property taxes and incentives for homebuyers, can impact the housing market. The availability of credit and interest rates also influence the affordability of housing for potential buyers. Furthermore, external factors like global economic trends and geopolitical instability can create uncertainty in the housing market, leading to fluctuations in prices. Overall, the interplay of these economic, regulatory, and external factors shapes the landscape of Greece's housing market and determines the current state of housing prices in the country.

Factors Affecting Greece Housing Prices

Several factors contribute to the fluctuation of housing prices in Greece. One significant factor is the overall economic stability of the country, as a strong economy typically leads to increased demand for housing and subsequently higher prices. Additionally, the availability of credit and interest rates play a crucial role in influencing housing affordability and, consequently, prices. The supply and demand dynamics in the housing market, including the level of new construction and the rate of population growth, also impact prices. Furthermore, government policies and regulations regarding property taxes, zoning laws, and incentives for homeownership can influence the housing market and prices. Overall, a combination of economic, financial, market, and regulatory factors collectively shape the housing prices in Greece.

City Centre: Impact of location on housing prices in major cities like Athens and Thessaloniki.

The location of the city center significantly impacts housing prices in major cities such as Athens and Thessaloniki in Greece. Properties situated in the city center are in high demand due to their proximity to key amenities, transportation hubs, and commercial districts. In Athens, the historic city center with its iconic landmarks and cultural attractions commands premium prices, reflecting the desirability of living in close proximity to these assets. Similarly, in Thessaloniki, properties located near the bustling city center experience higher housing prices as they offer convenient access to shopping centers, restaurants, and entertainment venues. The demand for housing in these prime locations drives up prices, making city center properties a sought-after investment in the real estate market of major Greek cities.

House Price: Analysis of the average price of houses in Greece.

The analysis of the average price of houses in Greece reveals a complex and dynamic market influenced by various factors. The housing prices in Greece have shown fluctuations in recent years due to economic instability, political changes, and the impact of the global financial crisis. Additionally, the demand for housing in popular tourist destinations has also played a significant role in shaping the pricing trends. Factors such as location, size, condition, and amenities of the properties further contribute to the variation in prices across different regions of Greece. Understanding these nuances is crucial for investors, policymakers, and individuals seeking to navigate the Greek housing market effectively.

Average Price: Examination of the overall average housing price in Greece.

The average price of housing in greece fluctuates based on various factors such as location, size, and market demand. As of the most recent data available, the overall average housing price in Greece stands at approximately €150,000. However, it is important to note that this figure can vary significantly between regions, with urban areas typically commanding higher prices compared to rural areas. Factors such as the economic climate, government policies, and external influences also play a role in shaping the housing market in Greece. Overall, a comprehensive examination of the average housing price in Greece reveals a dynamic and diverse market landscape that is influenced by a multitude of factors.

Real Estate: Role of the real estate market in determining housing prices.

The real estate market plays a crucial role in determining housing prices in Greece. Various factors such as supply and demand dynamics, economic conditions, interest rates, and government policies significantly influence the pricing of residential properties. In recent years, the Greek housing market has experienced fluctuations due to the country's economic challenges, leading to both increases and decreases in property values. Additionally, the location, quality, and amenities of a property also impact its price. Overall, the real estate market serves as a key determinant of housing prices in Greece, reflecting the broader economic landscape and market conditions.

Visa Program: Influence of the Greek visa program on housing prices.

The Greek visa program has had a notable influence on housing prices in the country. With the implementation of the program offering residency permits to non-EU citizens purchasing real estate exceeding a certain value, there has been a surge in demand for high-end properties, particularly in popular tourist destinations and major cities. This increased demand has led to a corresponding rise in housing prices, as foreign investors seek to capitalize on the opportunity to obtain residency in Greece through property investment. As a result, the Greek visa program has contributed to the appreciation of housing prices in key real estate markets, shaping the landscape of the housing sector in the country.

Price Greece: Comparison of housing prices in Greece with other countries.

A comparison of housing prices in Greece with those in other countries reveals a notable disparity in the cost of real estate. While Greece has experienced fluctuations in its housing market due to economic instability, the prices remain relatively lower compared to many other developed nations. For instance, in major cities like Athens and Thessaloniki, the average price per square meter is significantly lower than in cities like London, New York, or Tokyo. This affordability has made Greece an attractive destination for foreign investors seeking to capitalize on the relatively low property prices. However, it is essential to consider factors such as the overall economic stability, property regulations, and potential for appreciation when making comparisons between housing prices in Greece and other countries.

Past Year: Review of housing price trends in the past year.

Over the past year, the housing price trends in Greece have shown notable fluctuations and shifts. Despite initial stability, the onset of the global pandemic brought about a period of uncertainty and decline in the housing market. As lockdown measures and economic challenges persisted, the demand for housing saw a significant decrease, leading to a corresponding drop in prices. However, as the situation gradually improved and restrictions began to ease, there was a gradual recovery in the housing market towards the latter part of the year. Government initiatives and incentives aimed at stimulating the real estate sector also played a role in boosting market activity. Overall, the past year has been characterized by a mix of challenges and opportunities in the Greek housing market, reflecting the broader economic landscape influenced by the pandemic.

Greece Good: Assessment of the attractiveness of Greece as a housing market.

The attractiveness of Greece as a housing market is multifaceted and warrants a thorough assessment. Greece's housing market presents a unique blend of historical charm, picturesque landscapes, and a rich cultural heritage, making it a desirable location for potential homebuyers. The relatively affordable housing prices in certain regions of Greece, coupled with the potential for investment growth, add to the appeal of the market. However, factors such as economic instability, bureaucratic hurdles, and fluctuating property taxes may pose challenges for both domestic and international buyers. Overall, while Greece offers an alluring housing market with its Mediterranean allure and potential for investment, careful consideration of the market's complexities is essential for making informed decisions.

Apartment Bedroom: Impact of the number of bedrooms on apartment prices.

In the context of Greece's housing market, the number of bedrooms in an apartment significantly impacts the overall price of the property. Apartments with a higher number of bedrooms tend to command higher prices due to the increased living space and accommodation potential they offer. In urban areas where space is limited, apartments with more bedrooms are particularly sought after, leading to a higher demand and subsequently higher prices. Additionally, larger apartments with more bedrooms are often perceived as more luxurious and desirable, appealing to buyers or renters looking for ample living space. As a result, the number of bedrooms plays a crucial role in determining the pricing structure of apartments in the Greek housing market, with a direct correlation between the two factors.

Gross Rental: Relationship between rental income and housing prices.

The concept of Gross Rental refers to the relationship between rental income and housing prices, particularly within the context of Greece's real estate market. In this scenario, the Gross Rental serves as a crucial indicator of the overall health and dynamics of the housing sector. When housing prices experience fluctuations, it directly impacts the rental income generated from properties. Generally, an increase in housing prices tends to lead to higher rental incomes, as property owners can command higher rents to match the increased value of their assets. Conversely, a decline in housing prices may result in reduced rental income, as landlords may have to adjust their rental rates to remain competitive in the market. Therefore, understanding the relationship between rental income and housing prices is essential for stakeholders in the Greek real estate market to make informed decisions and assess the profitability of their property investments.

Recent Year: Examination of recent changes in housing prices.

In the recent year, an examination of the changes in housing prices in Greece reveals a notable trend. Despite facing economic challenges in the past, Greece has experienced a gradual increase in housing prices, particularly in urban areas and popular tourist destinations. Factors such as increased demand from foreign investors, a growing population in metropolitan regions, and government incentives for property development have contributed to this upward trajectory. Additionally, the implementation of reforms aimed at stabilizing the real estate market has bolstered investor confidence. However, it is crucial for policymakers and stakeholders to monitor these developments closely to ensure sustainable growth and affordability for prospective homebuyers in the future.

Price Rise: Analysis of the reasons behind price rises in the housing market.

Price rise in the Greek housing market can be attributed to several key factors. One significant reason is the increased demand for properties in popular tourist destinations, leading to a shortage of available housing units. Additionally, low-interest rates and favorable lending conditions have encouraged more individuals to invest in real estate, further driving up prices. Furthermore, the limited supply of land for development in certain areas has also contributed to the escalation of housing costs. The combination of these factors has created a competitive market environment, resulting in a steady increase in property prices across Greece. In order to address this issue, policymakers may need to consider implementing measures to regulate speculative investments and increase the availability of affordable housing options for residents.

Golden Visa: Evaluation of the influence of the Golden Visa program on housing prices.

The Golden Visa program has had a notable influence on housing prices in Greece. The implementation of this program, which offers residency permits to non-EU citizens in exchange for significant real estate investments, has led to an influx of foreign investors seeking to capitalize on the benefits of the scheme. This surge in demand for properties, particularly in popular tourist destinations and major cities, has contributed to a notable increase in housing prices. Additionally, the program has also fueled competition among investors, further driving up prices in certain segments of the market. Consequently, the Golden Visa program has played a significant role in shaping the dynamics of the Greek real estate market, with its impact on housing prices being a prominent feature of its overall influence.

Interest Rate: Impact of interest rates on housing affordability and prices.

The impact of interest rates on housing affordability and prices in Greece is significant. Fluctuations in interest rates directly influence the cost of borrowing for potential homebuyers, thereby affecting their purchasing power and overall affordability. Lower interest rates generally stimulate demand for housing, as they reduce the cost of financing a home purchase. This increased demand can lead to higher housing prices, as buyers are willing to pay more for properties. Conversely, higher interest rates can deter buyers due to increased borrowing costs, potentially slowing down the housing market and putting downward pressure on prices. Therefore, it is crucial for policymakers and market participants in Greece to closely monitor interest rate movements, as they play a pivotal role in shaping the dynamics of housing affordability and prices in the country.

Social Security: Role of social security policies in housing price dynamics.

Social security policies play a significant role in the dynamics of housing prices in Greece. The implementation of social security measures can influence the housing market through various channels. For instance, social security programs that provide financial assistance to low-income individuals or retirees may impact the demand for housing, thereby affecting prices. Additionally, the stability and adequacy of social security systems can influence consumer confidence and overall economic stability, which in turn can impact housing market dynamics. Moreover, social security policies that address issues such as unemployment, poverty, and social inequality can have indirect effects on housing prices by shaping the overall socio-economic environment in which the housing market operates. Therefore, a comprehensive understanding of the interplay between social security policies and housing price dynamics is essential for policymakers and stakeholders in the Greek housing market.

Year Year: Comparison of housing prices year by year.

The comparison of housing prices in Greece year by year reveals significant fluctuations and trends in the real estate market. Over the past decade, there has been a notable pattern of both growth and decline in housing prices. For instance, in the aftermath of the global financial crisis of 2024, Greece experienced a severe economic downturn, leading to a sharp decrease in property values. However, in more recent years, there has been a gradual recovery in the housing market, with prices showing signs of stabilization and even growth in certain regions. Factors such as government policies, economic conditions, and demand-supply dynamics continue to play a crucial role in shaping the trajectory of housing prices in Greece. Understanding these trends can provide valuable insights for both prospective homebuyers and investors looking to navigate the Greek real estate market effectively.

Greek Government: Influence of government policies on housing prices.

The Greek government plays a significant role in shaping the housing market through its policies, which directly impact housing prices. Government interventions such as tax incentives, subsidies, and regulations can either stimulate or deter investment in the housing sector, thus affecting property values. For instance, policies that promote urban development or provide support for homebuyers can lead to an increase in demand for housing, consequently driving up prices. Conversely, stringent regulations or changes in taxation can have the opposite effect, leading to a decrease in housing prices. Therefore, it is crucial for policymakers to carefully consider the implications of their decisions on the housing market to ensure a stable and sustainable environment for both buyers and sellers.

Bank Greece: Role of Greek banks in the housing market.

Greek banks play a significant role in the country's housing market by providing essential financial services to both homebuyers and property developers. The availability of mortgage loans and other forms of financing offered by Greek banks greatly influences the purchasing power of individuals looking to buy a home. Additionally, Greek banks play a crucial role in facilitating real estate transactions by offering various financial products tailored to the needs of the housing market. Moreover, the stability and lending practices of Greek banks can impact the overall health of the housing market, as they influence the accessibility of credit and interest rates for potential homebuyers. As such, the role of Greek banks in the housing market is integral to the functioning and growth of the real estate sector in Greece.

Year Average: Analysis of the average housing price over multiple years.

The analysis of the year average of housing prices in Greece provides valuable insights into the trends and fluctuations within the real estate market over multiple years. By calculating and examining the average housing price across different years, researchers and policymakers can identify patterns, assess the overall market stability, and make informed decisions regarding housing policies and investments. This analysis not only helps in understanding the economic factors influencing housing prices but also aids in predicting future trends and potential risks within the Greek real estate sector. Additionally, a detailed examination of the year average allows for comparisons with other countries or regions, offering a broader perspective on the housing market's performance and competitiveness.

Square Meter: Examination of housing prices per square meter.

The examination of housing prices per square meter in Greece offers valuable insights into the current real estate market trends and economic dynamics. By analyzing the cost of properties based on their size, stakeholders can better understand the affordability and investment potential within the housing sector. This metric provides a standardized method for evaluating the value of residential properties, allowing for comparisons across different regions and property types. Additionally, the square meter pricing data serves as a crucial tool for both buyers and sellers in making informed decisions regarding property transactions. Overall, a thorough examination of housing prices per square meter in Greece is essential for comprehensively assessing the state of the real estate market and its implications on the broader economy.

Residence Permit: Influence of residence permits on housing prices.

Residence permits can have a significant influence on housing prices in Greece. The availability and accessibility of residence permits can impact the demand for housing in specific areas, thereby affecting prices. In regions where there is a high demand for residence permits, such as popular tourist destinations or areas with strong economic opportunities, housing prices tend to rise as individuals seek to secure housing in order to qualify for residency. This increased demand can lead to a competitive housing market, driving prices up. Conversely, in areas where residence permits are less sought after, housing prices may not experience the same level of inflation. Therefore, it is evident that the issuance and regulations surrounding residence permits play a crucial role in shaping the housing market dynamics in Greece.

Increase Number: Impact of the increasing number of housing units on prices.

The impact of the increasing number of housing units on prices in Greece is a complex issue that involves various factors. The construction of new housing units can lead to an increase in supply, which, in turn, may put downward pressure on prices. However, the demand for housing in greece is also influenced by factors such as population growth, economic conditions, and government policies. Therefore, while an increase in the number of housing units may have a moderating effect on prices in the short term, the long-term impact will depend on the interplay of supply and demand dynamics in the housing market. Additionally, the location and quality of the new housing units will also play a crucial role in determining their impact on prices.

Major City: Comparison of housing prices in major cities.

When comparing housing prices in major cities in Greece, it is evident that there are significant variations depending on the location. Athens, as the capital and largest city, tends to have the highest housing prices, particularly in desirable neighborhoods close to the city center or with sea views. Thessaloniki, the second largest city, also commands relatively high prices, especially in popular areas near the waterfront or with historical significance. On the other hand, cities like Patras and Heraklion may offer more affordable housing options, with prices influenced by factors such as local economy, demand, and proximity to amenities. Overall, the housing market in major Greek cities reflects a diverse range of prices, catering to different preferences and budgets.

Residential Property: Analysis of the housing market for residential properties.

An analysis of the housing market for residential properties in Greece reveals a complex landscape influenced by various factors. The housing market in Greece has experienced fluctuations in recent years due to the country's economic challenges, including the financial crisis of the late 2000s. As a result, housing prices have been volatile, with periods of decline followed by gradual recovery. Additionally, factors such as location, property size, and amenities play a significant role in determining the prices of residential properties in different regions of Greece. In recent years, there has been an increasing demand for residential properties in popular tourist destinations, driving up prices in these areas. Overall, a comprehensive analysis of the housing market for residential properties in Greece requires a nuanced understanding of economic trends, consumer preferences, and regional dynamics.

Average Cost: Evaluation of the average cost of housing in greece.

The evaluation of the average cost of housing in Greece reveals a complex landscape influenced by various factors. As of the most recent data available, the average cost of housing in Greece varies significantly depending on the region, with urban areas such as Athens and Thessaloniki commanding higher prices compared to rural areas. Additionally, the type of property, its size, condition, and proximity to amenities all play a crucial role in determining the overall cost. Despite the economic challenges faced by Greece in recent years, the housing market has shown resilience, with prices experiencing fluctuations in response to market conditions and government policies. Further research and analysis are necessary to gain a comprehensive understanding of the intricacies of housing costs in greece.

Accord Bank: Role of Accord Bank in the housing market.

Accord Bank plays a pivotal role in the Greek housing market by providing essential financial services and support to individuals seeking to purchase property. As a key player in the banking sector, Accord Bank offers various mortgage products and loans tailored to meet the diverse needs of potential homeowners. Through its competitive interest rates and favorable terms, Accord Bank facilitates access to housing finance, thereby stimulating demand and activity within the housing market. Additionally, the bank's expertise in risk assessment and financial advisory services ensures responsible lending practices, contributing to the overall stability and growth of the housing sector in Greece. Overall, Accord Bank's presence and contributions are instrumental in promoting homeownership and driving economic development within the Greek housing market.

Greek Island: Influence of Greek islands on housing prices.

The Greek islands hold a significant influence on housing prices in Greece due to their unique appeal and desirability among both domestic and international buyers. The picturesque landscapes, stunning sea views, and rich cultural heritage of the Greek islands make them highly sought-after locations for real estate investment. As a result, the limited supply of housing on these islands, coupled with high demand, often leads to higher property prices compared to mainland Greece. Additionally, the tourism industry on the Greek islands plays a crucial role in driving up housing prices, as many investors purchase properties for short-term rentals to capitalize on the influx of tourists during the peak season. Overall, the allure of the Greek islands contributes to the premium pricing of real estate in these idyllic locations.

Greek Property: Assessment of the value and demand for Greek properties.

The assessment of the value and demand for Greek properties is a multifaceted endeavor influenced by a variety of economic, social, and political factors. Greece's housing market has experienced fluctuations in recent years, with both domestic and international investors closely monitoring the trends. The value of Greek properties is intricately tied to the overall economic conditions of the country, including factors such as GDP growth, employment rates, and interest rates. Additionally, the demand for Greek properties is influenced by factors such as tourism trends, migration patterns, and government policies related to property ownership and investment. Conducting a thorough analysis of the Greek property market involves examining a range of indicators, including property prices, rental yields, market liquidity, and regional variations in demand. Such an assessment is essential for stakeholders seeking to make informed decisions regarding investment opportunities in the Greek real estate sector.

Datum Display: Utilization of data display techniques to analyze housing prices.

The utilization of data display techniques to analyze housing prices in Greece provides a comprehensive insight into the trends and fluctuations within the real estate market. By employing datum display, researchers and analysts can effectively visualize and interpret the vast amount of housing data available, allowing for a more in-depth understanding of the factors influencing pricing dynamics. Through the use of graphs, charts, and other visualization tools, patterns and correlations can be identified, enabling stakeholders to make informed decisions regarding investment, development, and policy-making in the housing sector. Overall, the application of data display techniques in analyzing housing prices in Greece plays a crucial role in facilitating evidence-based decision-making and fostering a deeper understanding of the market dynamics.

High Quality: Impact of high-quality housing on prices.

In the context of Greece's housing market, the impact of high-quality housing on prices is significant. High-quality housing, characterized by modern amenities, premium construction materials, and superior design, tends to command higher prices due to its perceived value and desirability among buyers. Such properties often attract a more affluent clientele willing to pay a premium for the enhanced living experience and potential long-term investment value. Additionally, high-quality housing can contribute to the overall appreciation of property values in a given area, as it sets a benchmark for pricing and elevates the perceived standard of living in the neighborhood. Consequently, the presence of high-quality housing can have a positive spillover effect on surrounding property values, further influencing the dynamics of the housing market in Greece.

Square Foot: Examination of housing prices per square foot.

The examination of housing prices per square foot in Greece provides valuable insights into the real estate market dynamics within the country. By analyzing the cost of properties based on their square footage, one can gain a comprehensive understanding of the pricing trends and variations across different regions in Greece. This method of evaluation allows for a more precise comparison of property values, facilitating informed decision-making for both buyers and sellers in the housing market. Furthermore, the examination of housing prices per square foot serves as a reliable indicator of the overall economic health and stability of the real estate sector in Greece, aiding in the assessment of investment opportunities and market conditions.

Greece Remain: Assessment of the stability of housing prices in Greece.

The stability of housing prices in Greece remains a topic of concern and scrutiny. Despite the economic challenges faced by the country in recent years, the housing market has shown signs of resilience. Various factors contribute to the assessment of housing price stability in Greece, including economic indicators, government policies, and market demand. While fluctuations in housing prices have been observed, particularly in urban areas and popular tourist destinations, overall stability has been maintained. The impact of external factors, such as global economic trends and geopolitical events, also play a significant role in shaping the housing market in Greece. Continuous monitoring and analysis of these factors are essential for a comprehensive assessment of the stability of housing prices in the country.

Apartment Price: Analysis of the average price of apartments in Greece.

The analysis of the average price of apartments in Greece reveals a notable trend of fluctuation over recent years. Factors such as economic conditions, demand-supply dynamics, and government policies significantly impact the housing market in Greece. Despite experiencing a period of decline following the global financial crisis, the prices have shown signs of recovery in recent times. Regions like Athens and popular tourist destinations tend to have higher average apartment prices compared to rural areas. It is crucial for investors, policymakers, and prospective buyers to closely monitor these trends to make informed decisions in the Greek real estate market.

Property Price: Evaluation of the overall property price trends in Greece.

The evaluation of the overall property price trends in Greece reveals a complex and dynamic landscape. In recent years, Greece has experienced fluctuations in housing prices, influenced by various factors such as economic conditions, market demand, and government policies. Following the economic crisis that hit the country, property prices plummeted significantly, creating opportunities for investors and homebuyers. However, in more recent times, there has been a gradual recovery in the housing market, with prices showing signs of stabilizing and even increasing in some regions. It is important for potential buyers and investors to closely monitor these trends and seek professional advice to make informed decisions in the Greek real estate market.

Mykonos Santorini: Influence of popular tourist destinations on housing prices.

The popular tourist destinations of Mykonos and Santorini in Greece exert a significant influence on housing prices within their respective real estate markets. The allure of these islands as sought-after travel destinations has led to a surge in demand for housing, particularly among foreign investors and affluent individuals seeking vacation homes. This high demand, coupled with limited supply due to strict building regulations and geographical constraints, has resulted in a notable increase in property prices on both islands. The prestige associated with owning property in these exclusive locations further drives up housing prices, creating a competitive market environment that often favors sellers. Consequently, the influence of Mykonos and Santorini as popular tourist destinations has played a pivotal role in shaping the housing market dynamics and pricing trends in these areas.

Estate Market: Overview of the Greek real estate market and its impact on housing prices.

The Greek real estate market has undergone significant fluctuations in recent years, leading to a notable impact on housing prices throughout the country. Factors such as economic instability, political uncertainty, and the aftermath of the financial crisis have contributed to the volatility in the market. In particular, the implementation of austerity measures and the high levels of unemployment have hindered the purchasing power of potential buyers, leading to a decrease in demand for housing. Additionally, the oversupply of properties in certain regions has further exacerbated the situation, causing prices to stagnate or even decline in some areas. As a result, the Greek real estate market continues to face challenges in achieving stability and sustainable growth, with the impact on housing prices being a significant concern for both investors and homeowners alike.

City Greece: Comparison of housing prices in different cities across Greece.

A comparison of housing prices across different cities in Greece reveals significant variations in the real estate market. The capital city, Athens, stands out as one of the most expensive cities for housing, with prices driven up by high demand and limited availability of properties. On the other hand, smaller cities such as Thessaloniki and Heraklion offer more affordable housing options, attracting both local residents and investors. Additionally, popular tourist destinations like Santorini and Mykonos command premium prices for housing due to their picturesque locations and high demand for vacation rentals. Overall, the housing market in Greece reflects the diverse economic landscapes of its cities, with prices influenced by factors such as location, demand, and amenities.

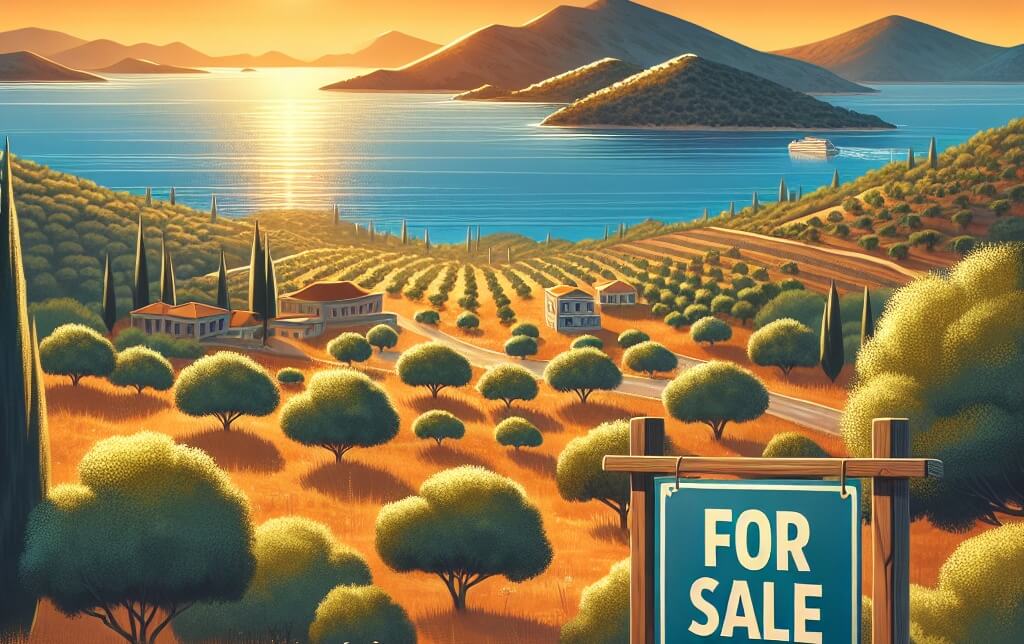

Buy Property: Factors to consider when buying property in Greece.

When considering buying property in Greece, there are several factors that one must carefully evaluate. Firstly, the location of the property is crucial as it can significantly impact its value and potential for appreciation. Researching the local real estate market trends, amenities, and infrastructure developments in the area is essential to make an informed decision. Additionally, understanding the legal procedures and regulations concerning property ownership in Greece is vital to avoid any potential pitfalls or complications. It is also recommended to assess the property's condition, potential renovation costs, and any hidden expenses that may arise. Lastly, consulting with a reputable real estate agent or legal advisor can provide valuable insights and guidance throughout the purchasing process.