Dubai Real Estate Crash 2024

The Dubai real estate crash of 2024 serves as a cautionary tale for the global real estate market, prompting stakeholders to closely monitor the sector for potential vulnerabilities. In light of the lessons learned from the 2024 crisis, the prospect of a Dubai real estate crash in 2024 warrants serious attention and proactive measures. It is essential for policymakers, investors, and industry professionals to conduct thorough risk assessments, implement stringent regulations, and foster transparency to mitigate the risk of another market downturn. By learning from past mistakes and adopting a prudent approach, stakeholders can work towards ensuring the stability and sustainability of the Dubai real estate market in the face of potential challenges.

I. Introduction

The Dubai real estate crash of 2024 was a significant event that had far-reaching implications for the global economy. This crisis was characterized by a sudden and dramatic downturn in the real estate market in Dubai, leading to a sharp decline in property prices and a wave of foreclosures and bankruptcies. The repercussions of this crash were felt not only in Dubai but also reverberated throughout the international financial system, highlighting the interconnectedness of the global real estate market. In this analysis, we will delve deeper into the causes, consequences, and lessons learned from the Dubai real estate crash of 2024.

II. Causes of the Dubai Real Estate Crash

The Dubai real estate crash of 2024 was primarily caused by a combination of factors that led to the sudden and significant decline in property prices and market activity. One of the main causes was the global financial crisis that originated in the United States, which resulted in a liquidity crunch and reduced investor confidence worldwide. Additionally, the speculative nature of the real estate market in Dubai, characterized by excessive borrowing and overleveraging, further exacerbated the situation. The rapid expansion of the market without sufficient oversight and regulation also played a significant role in creating an unsustainable bubble that eventually burst. Furthermore, the lack of transparency in the market and the absence of effective risk management practices contributed to the severity of the crash. Overall, the convergence of these factors led to a sharp downturn in the Dubai real estate sector in 2024.

III. Key Players and Entities

In the context of the Dubai real estate crash of 2024, key players and entities that significantly impacted the market included major developers such as Emaar Properties, Nakheel, and dubai properties Group. These companies were at the forefront of the rapid expansion and construction boom that characterized Dubai's real estate sector in the years leading up to the crash. Additionally, financial institutions like Dubai Islamic Bank and Emirates NBD played crucial roles in providing funding for real estate projects, which ultimately contributed to the overheating of the market. The regulatory environment, in particular the Real Estate Regulatory Authority (RERA), also played a key role in overseeing the industry and implementing measures to address the aftermath of the crash.

IV. Impact on the Dubai Real Estate Market

The Dubai real estate crash of 2024 had a profound impact on the Dubai real estate market. The crash resulted in a significant decline in property prices, with some areas experiencing a drop of over 50%. This sudden downturn led to a wave of foreclosures and a sharp decrease in real estate transactions. Investors and developers faced financial losses and struggled to recover from the crisis. The oversupply of properties, coupled with the global financial crisis, exacerbated the situation, causing a ripple effect across the entire real estate sector in Dubai. The crash served as a stark reminder of the risks associated with speculative investments in the real estate market and prompted a period of reflection and restructuring within the industry.

V. Government Response and Measures

In response to the Dubai real estate crash of 2024, the government implemented various measures to mitigate the impact and stabilize the market. The Dubai government introduced stricter regulations on property developers, increased transparency in real estate transactions, and established oversight mechanisms to monitor the sector more effectively. Additionally, the government injected liquidity into the market to provide support to struggling developers and prevent further destabilization. These measures aimed to restore investor confidence, attract foreign investment, and stimulate the real estate sector's recovery. The government's proactive response played a crucial role in addressing the challenges posed by the crash and laying the foundation for the market's gradual recovery.

VI. Regional and Global Context

In the aftermath of the Dubai real estate crash in 2024, the regional and global context played a significant role in shaping the recovery process. Regionally, the crash had reverberating effects on other Gulf countries, as investors became more cautious and risk-averse towards real estate investments in the region. Globally, the crisis highlighted the interconnectedness of the world economy, with repercussions felt across international financial markets. The decline in property prices in Dubai had ripple effects on global real estate markets, serving as a cautionary tale for the fragility of speculative bubbles. Moving forward, a more cautious approach to real estate investments, improved regulations, and a focus on sustainable growth became essential in navigating the regional and global context post the Dubai real estate crash of 2024.

VII. Long-Term Effects and Recovery

The Dubai real estate crash of 2024 had significant long-term effects on the economy and the real estate market in the region. The crash resulted in a sharp decline in property prices, leading to a decrease in investment and construction activities. As a consequence, many real estate projects were put on hold or canceled, causing financial distress for developers and investors. The recovery process was slow and challenging, requiring government intervention and policy changes to stabilize the market. Over time, the real estate sector in Dubai has gradually recovered, with property prices showing signs of improvement. However, the crash served as a reminder of the importance of sustainable development practices and prudent financial management to prevent similar crises in the future.

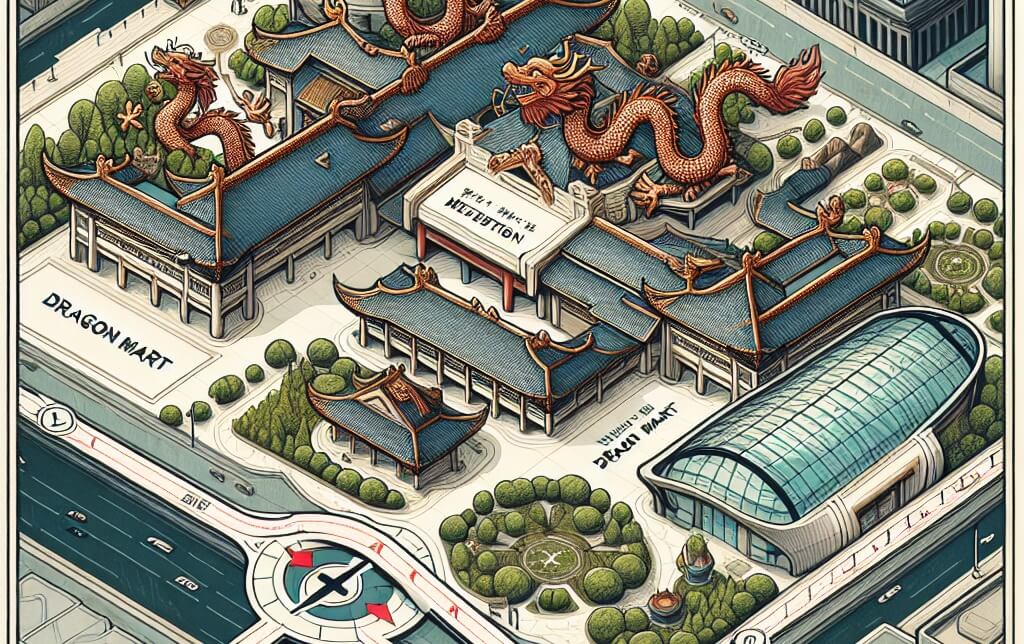

VIII. Comparison with Other Landmarks and Developments

In comparing the Dubai real estate crash of 2024 with other landmarks and developments, it becomes evident that the magnitude of the crisis was significant on a global scale. The collapse of the real estate market in Dubai had reverberating effects not only within the region but also across international financial markets. The scale of the crash was comparable to other major economic downturns, such as the 2024 global financial crisis and the 1997 Asian financial crisis. The rapid expansion and subsequent contraction of the real estate sector in Dubai mirrored the speculative bubbles seen in other markets, leading to a sharp decline in property values and investor confidence. The aftermath of the Dubai real estate crash serves as a cautionary tale of the risks associated with unchecked growth and speculative investments in the real estate sector.

IX. Economic Factors

In the aftermath of the Dubai real estate crash of 2024, economic factors played a pivotal role in shaping the extent of the crisis. The speculative nature of the real estate market, coupled with excessive lending and overleveraging, created a bubble that eventually burst, leading to a sharp decline in property prices and widespread financial instability. The lack of regulatory oversight and transparency further exacerbated the situation, as investors lost confidence in the market and liquidity dried up. The economic downturn that followed highlighted the interconnectedness of global financial markets and underscored the importance of sound economic policies and risk management practices in safeguarding against future crises.

X. Expert Opinions and Studies

Expert opinions and studies regarding the Dubai real estate crash of 2024 have shed light on several key factors that contributed to the crisis. According to renowned economists and analysts, the rapid growth and speculation in the real estate market, coupled with excessive borrowing and a lack of regulatory oversight, were significant drivers of the crash. Studies have also highlighted the role of global economic conditions and the bursting of the housing bubble in the United States as external factors that exacerbated the situation in Dubai. Additionally, experts have emphasized the importance of implementing stricter regulations and risk management practices to prevent similar crises in the future. Overall, the insights provided by experts and studies offer valuable lessons for understanding the complexities of the Dubai real estate crash and underscore the importance of informed decision-making in the real estate sector.